When bitcoin adoption reaches a global scale, it is likely there will no longer be bitcoin podcasts, bitcoin conferences or even, sorry to say this, a need for a Bitcoin Magazine. However, until this point, people interested in bitcoin will be differentiated from those who are yet to begin their journey down the bitcoin rabbit hole. The question is then raised, how does a bitcoiner describe themselves to others, that may help bridge the chasm between their own understanding and those still plugged into The Matrix?

Given the inflationary policies of successive governments, globally (see Rune Østgård excellent book Fraudcoin for more information), nearly everyone with resources has had to become an “investor” simply to attempt to maintain purchasing power overtime.

People who want to own the place they live, have the ability to personalise where they spend their time, and (for the most part) not be concerned about eviction or be subjected to excessive costs of rental, should not have to view themselves as investors. However, due to monetary premia commanded by real estate, not only do people need to take risks by leveraging their assets to purchase homes (through mortgages), they may also need to speculate that in the future, the value of their home will have increased sufficiently to offset the costs incurred of purchasing, moving and cover the interest on their debt.

Alongside the need to build wealth through “hard assets” such as property, the non-bitcoiner will be directed and often supported in planning for the future through further investments in the form of a pension. While tax efficiency and, for those lucky enough, additional employer contributions help to increase benefits, the investment related risks are reduced. However, these benefits also need to be understood in relation to the counterparties involved, such as changes in government policy, changes in pension schemes or the worst-case scenario of the company providing the pension experiencing financial difficulties. Learning that the pension you have been paying into for 30 years now has no value through no fault of your own is quite simply heartbreaking to watch.

Since the public acknowledgement by Blackrock that bitcoin may not actually be an “index of money laundering”, bitcoin as an investment grade asset is becoming an accepted narrative. This could mean that bitcoin can begin to be considered alongside equities, real estate and pensions as a means on maintaining purchasing power while also planning for the future. However, looking back, this perception may simply be a point on an ever changing journey, from its origins within a little known Cypherpunk mailing list that viewed it as a collectible, through the medium of exchange on the Silk Road to where we are today. With an eye on the future, it may be prudent to begin thinking of what description will come next for someone who owns bitcoin, that will make more sense in the future other than an “investor”. The very nature of bitcoin also suggests that it is unlike other assets (either commodities or securities), meaning that it might be wrong to view it as either.

Unfortunately, consistent with awareness of bitcoin not being even distributed, publicly held views of the asset are also rather inconsistent. As recently as May, 2023, Harriet Baldwin MP, of the UK Parliament Treasury Committee recommended that “unbacked ‘tokens’” (including bitcoin), should be regulated as “gambling rather than as a financial service”. While this is largely true for “cryptoassets” more broadly, this is simply wrong in relation to bitcoin, given it is backed by the world’s largest computer network running a protocol that is extremely resilient to change. The nature of the bitcoin protocol means that unlike real estate or pensions, changes in government, organisational policies or an organisation’s performance cannot affect its operation or utility in the future. In combination with this, given the fixed supply of bitcoin, it is also not subjected to debasement through inflationary policies that affects the unit of account for other assets.

As a consequence, while past data shows the dollar value of bitcoin is highly volatile (impacted by supply and demand dynamics), the risks associated with the asset itself are actually extremely low. When this is combined with the ability to self-custody the asset, at low cost, further risks are removed when compared to the need for shares in companies or commodity certificates to be custodied by brokerage firms.

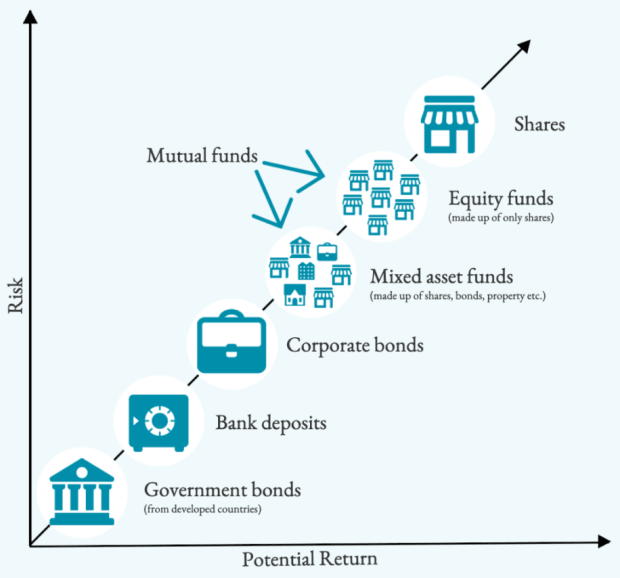

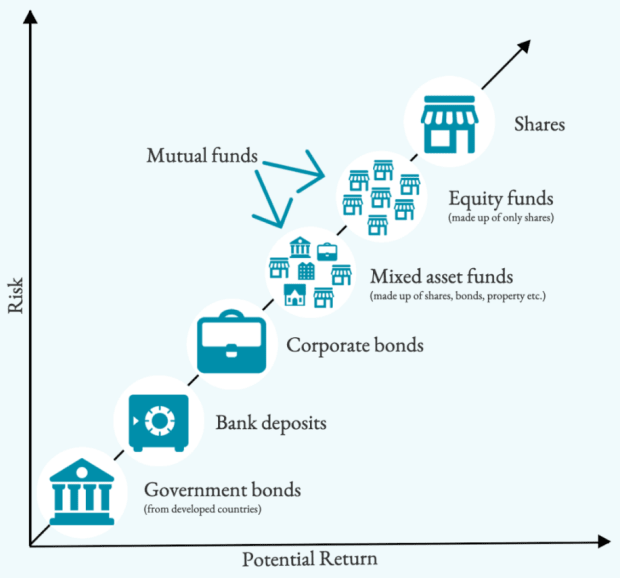

Standard definitions of investing focus upon an expectation that money invested will grow, even though any informed investor will do this by balancing the potential growth against any associated risks. From the treasury committee’s viewpoint, the risks and returns associated with gambling would likely locate bitcoin beyond the top right corner of the figure below.

From the perspective of buying bitcoin being similar in nature of gambling, selling a fiat currency for bitcoin, with a chance, rather than an expectation of growth may then suggest that bitcoin may not actually be able to be classed as an investment.

To further question the above figure, times appear to have changed from when this well-established idea was developed, precipitating the need for reflections on previously held assumptions. Government bonds are no longer “risk free”, illustrated by the global interest rates increases resulting in dramatic losses in the value of government bonds in 2022. This situation has then impacted the risks associated with bank deposits, leading to recent failures of large banks in the US. In comparison to both government bonds and bank deposits, the security of bitcoin is neither subjected to central bank interest rate policy risk nor third-party risks associated with the holders of government bonds (even if the short-term value may change). Given the fixed emission schedule of bitcoin, it is also not subjected to “money printing” and government deficits that have reduced the purchasing power of the underlying currency, as promoted by Modern Monetary Theory.

Fascinatingly, in a recent document from Blackrock, this contrarian viewpoint is supported, suggests a bitcoin allocation of 84.9% within an investment portfolio, representing a very different risk profile when compared to other assets (Thank you Joe). Aside from the volatility associated with markets attempting to price a new asset, this suggests that bitcoin is where Blackrock would recommend holding the majority of your wealth. The figure below thus suggests an alternative framing when comparing bitcoin to other assets, where instead of presenting returns on investment, attention is given to the risks of the underlying unit of account (fiat currency) against the business risk.

Within the current high inflation environment, currency and business related risks are heightened. History then provides a sobering perspective on the impact of inflation on the well-being of a population (see When Money Dies). During Weimar Germany, as a result of the issues with the currency, those who invested experienced periods of positive returns, but were later ruined as hyperinflation took hold. In this context, rather than investing in gold, those who simply saved in it could ride out the volatile price movements. In a fascinating echo, the same has been demonstrated in Argentina today with bitcoin. Investors or traders are likely to have lost money, but in the long term, saving in bitcoin has been a much better option for the average Argentinian.

So yes, I am a bitcoiner, but that does not mean I am an investor, speculator, gambler or a criminal and while I’d like to be, I’m also not a Cypherpunk. I am simply someone working towards a better future for myself, my family and maybe even their families. Bitcoin appears to provide a means of transferring the value of my work today into the future, without the risks of it being mismanaged (equities), legislated against (pensions), at risk of central bank policy (government bonds and fiat currencies) or struck by lightning (real estate). As a result, bitcoin may not be an investment and is only a speculation or gamble if you buy it without understanding it.

To return to the title, when asked about themselves and how they are planning for the future, a bitcoiner can simply say, “I’m staying humble, appreciating I have a lot to learn but saving the best asset I can find” (see Mickey’s work for a macro viewpoint). Hopefully, this will pique their interest, so lead to the follow up question of “can you tell me more?”. At which point, the orange pilling can begin.

This is a guest post by Rupert Matthews. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source: bitcoinmagazine.com